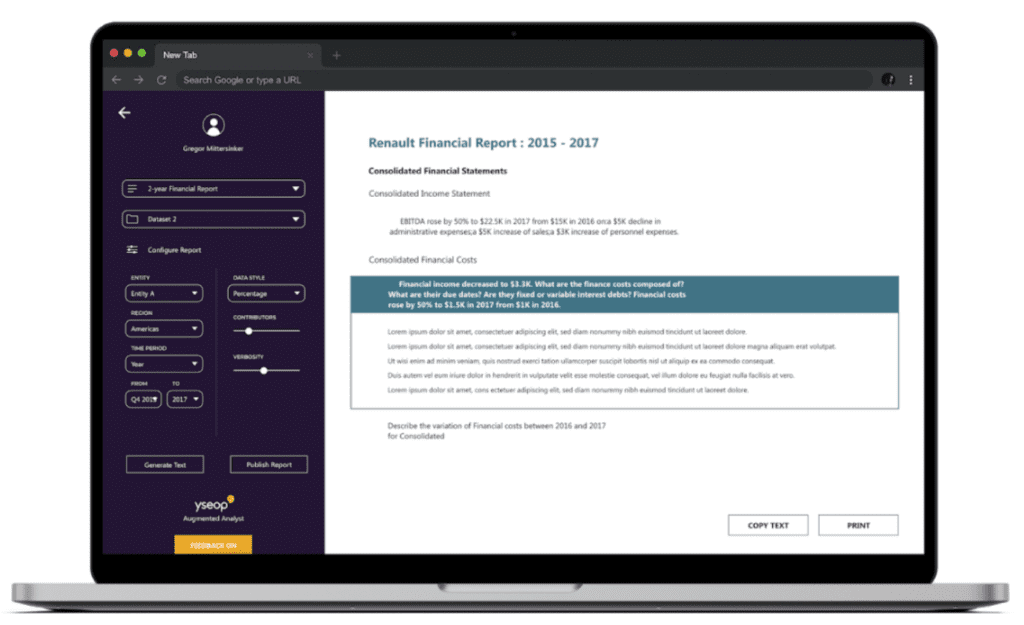

Increase efficiencies and productivity by automating core reporting tasks for medical writing.

Automate core regulatory report documents across the CTD pyramid and dramatically accelerate submission timelines.

Unlock new opportunities for business growth, by empowering your teams to make smarter decisions based on accurate data insights.

Modernize workflows to transform how your business operates in today’s digital world.